65 Main Street

Newfields NH 03856

Phone: 603-772-5070

Fax: 603-772-9004

suemckinnon@newfieldsnh.gov

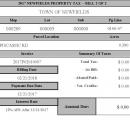

Property Tax

State and Local Property Taxes are due on July 1 and December 1 of each year. Property Tax Bills are sent to property owners in the month prior to the due date and copies can be obtained from the Tax Collector. The tax year is April 1 to March 31.The amount due each year is based on the Tax Rate Calculation which is set in the fall each year by the Department of Revenue Administration. The tax rate for 2023 is $15.79 per thousand at 100% valuation. Taxes are due on December 27, 2023.

Tax Appeals

With respect to tax matters, the State of NH Board of Tax and Land Appeals has responsibility for:

- Hearing appeals of individual tax assessments, exemptions or refunds, whether levied by the State or its municipalities; Tax Abatement Form

- Hearing petitions for reassessment and determining the adequacy of reassessments ordered by the board; and

- Determining any appeals of the equalization ratios established by the Commissioner of Revenue Administration.

For more information, rules and forms, please visit the State of NH Board of Tax and Land Appeals web page.

Tax Relief

Tax relief for low and moderate income homeowners is available. Please see the information and rules governing Tax Relief and the fill out the Low and Moderate Income Homeowners Property Tax Relief if applicable. For more information visit: https://www.revenue.nh.gov/faq/low-moderate.htm

Veterans are entitled to an exemption of $500 if they served in the military. Applications are available at the town office and are due by April 15.

If you are elderly, disabled, blind or unable to pay your taxes due to poverty or other good cause, you may be eligible for a tax exemption, credit, abatement or deferral. For details and application information, contact the Town Office.